What Comes to Mind When You Hear “AI”?

- Robots and automation?

- Job displacement concerns?

- Sci-fi movies and superintelligence?

Let’s explore how our perceptions of AI have evolved over time…

AI Through the Decades

-

1950: The Foundation

Alan Turing publishes “Computing Machinery and Intelligence,” introducing the Turing Test as a measure of machine intelligence.

-

1956: Birth of AI

John McCarthy coins “artificial intelligence” at the Dartmouth Conference, founding AI as a field.

-

1957: Neural Networks Begin

Frank Rosenblatt develops the Perceptron, the first artificial neural network capable of learning.

-

1965: Early Conversation

Joseph Weizenbaum creates ELIZA, the first chatbot that could engage in natural language conversation.

-

1968: Pop Culture Impact

HAL 9000 in “2001: A Space Odyssey” captures public imagination about AI possibilities and dangers.

-

1980s: Neural Network Revival

The backpropagation algorithm revitalizes neural network research after the “AI Winter.”

-

1997: Strategic Thinking

IBM’s Deep Blue defeats world chess champion Garry Kasparov, demonstrating AI’s strategic capabilities.

-

2011: Mainstream Adoption

IBM Watson wins Jeopardy! while Apple launches Siri, bringing AI to consumers.

-

2016: Go Champion Defeated

DeepMind’s AlphaGo defeats world Go champion Lee Sedol, mastering the most complex board game.

-

2017: Transformer Revolution

Google publishes “Attention Is All You Need,” introducing the architecture that powers all modern LLMs.

-

2018-2020: The GPT Era

OpenAI releases the GPT series (GPT-1, GPT-2, GPT-3), progressively more powerful language models.

-

November 2022: The ChatGPT Moment

OpenAI releases ChatGPT, making conversational AI accessible to the general public and sparking the current LLM revolution.

ChatGPT in Action

Let’s see ChatGPT in action:

This demonstration shows the conversational nature and capabilities of modern language models like ChatGPT.

Key observations: - Natural language interaction - Context awareness across conversation - Ability to explain complex topics clearly - Real-time reasoning and adaptation

Aims

🧠 Conceptual Insight

Understand the core mechanics of ChatGPT & other LLMs—how they learn, generate responses, and reason.

🛠️ Practical Mastery

Hands-on workflows, advanced prompting, and safety guardrails to integrate these tools into your daily work.

The AI Hierarchy

Interactive exploration of AI technology stack - Generated from manim class: AIHierarchyBuild - RevealJS: 10 interactive slides - Other formats: Consolidated video - Use arrow keys or space to navigate (RevealJS only)

The AI Hierarchy Video

Interactive presentation covering interactive exploration of ai technology stack

Video Details: - Duration: Full scene progression - File size: 1.1 MB - Format: MP4 (consolidated from 10 slides)

Understanding AI Technology

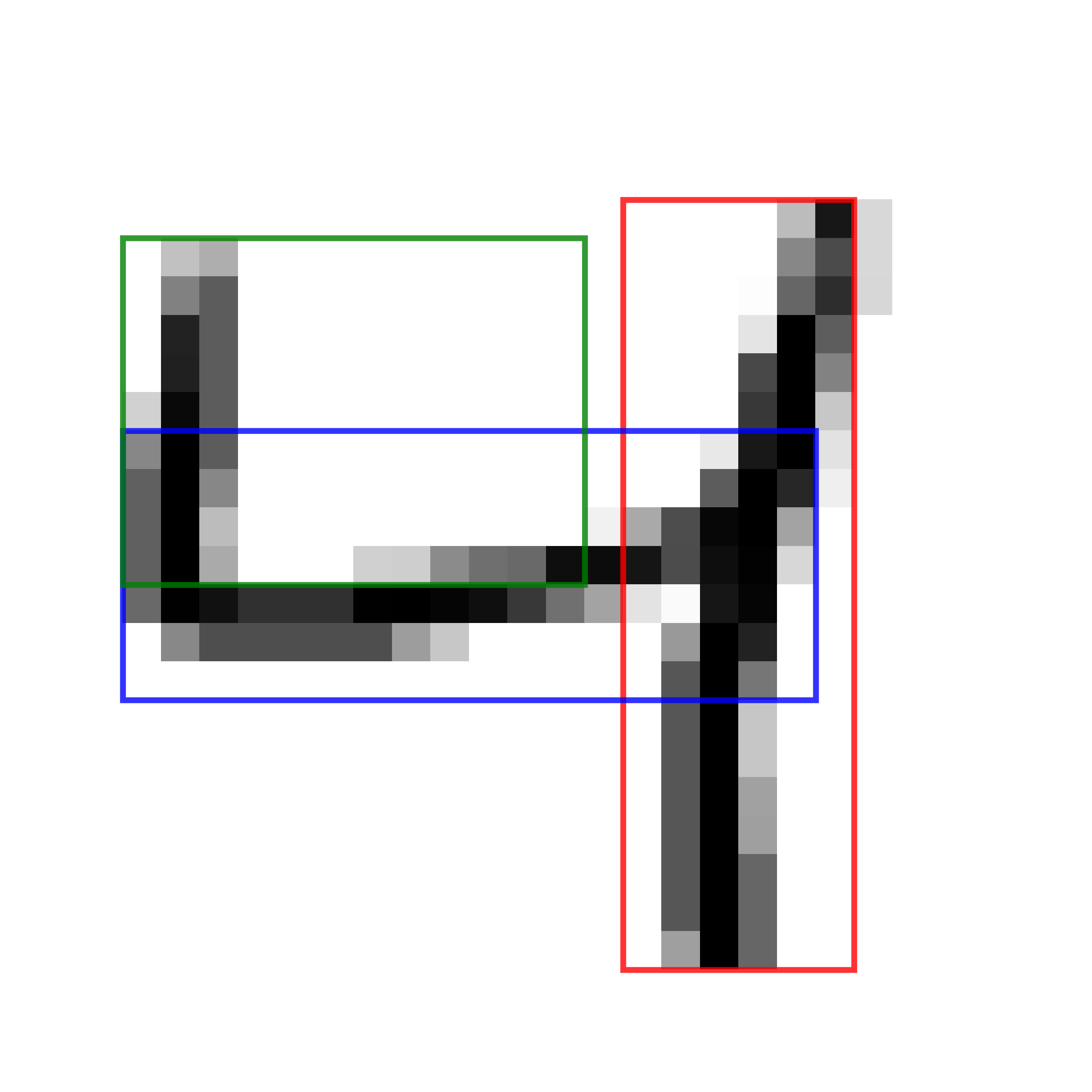

The Challenge: Recognizing This Handwritten Number

Traditional Programming Approach

def recognize_digit_4(image): # image is 28x28 pixels

# Check right vertical stroke (red region)

right_vertical = 0

for row in range(5, 25): # rows 5-24

for col in range(16, 22): # cols 16-21

if image[row][col] > 128: # bright pixel

right_vertical += 1

# Check horizontal crossbar (blue region)

horizontal = 0

for row in range(11, 18): # rows 11-17

for col in range(3, 21): # cols 3-20

if image[row][col] > 128:

horizontal += 1

# Check left vertical stroke (green region)

left_vertical = 0

for row in range(6, 15): # rows 6-14

for col in range(3, 15): # cols 3-14

if image[row][col] > 128:

left_vertical += 1

# Hardcoded thresholds for each region

if (right_vertical > 25 and horizontal > 30 and

left_vertical > 20):

return "4"

return "unknown"

Legend:

🔴 Right vertical stroke

🔵 Horizontal crossbar

🟢 Left vertical stroke

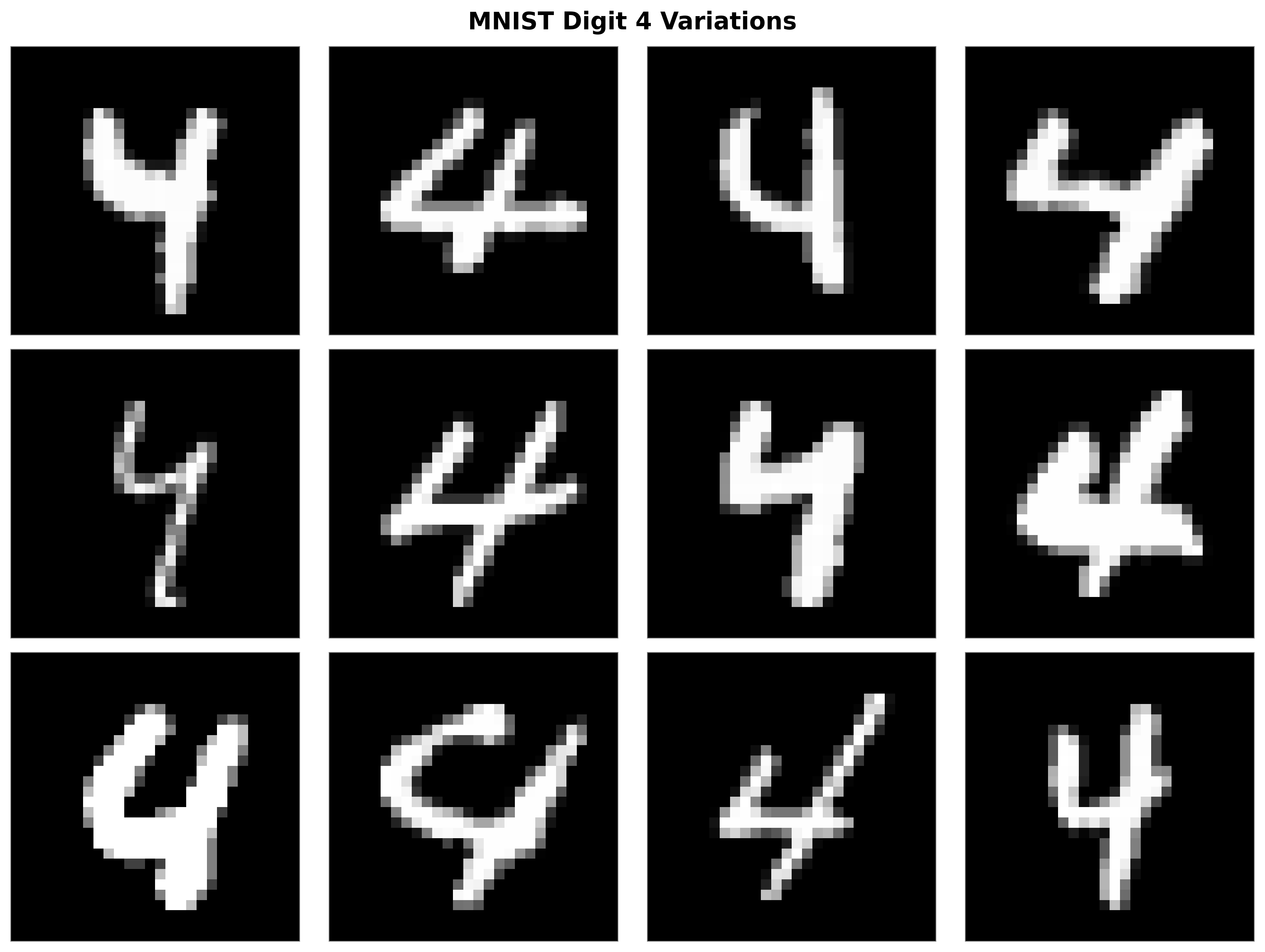

How do we handle variations?

Problems with our “4” detector:

- ❌ Different stroke thickness

- ❌ Rotated or shifted positions

- ❌ Artistic style variations

- ❌ Incomplete or broken strokes

- ❌ Different proportions

- ❌ Pixel intensity variations

The Reality: 5,842 different “4”s exist just in MNIST alone!

The Scale Problem: Why Traditional Programming Fails

We’ve only tackled the digit “4”

What about:

- 0, 1, 2, 3, 5, 6, 7, 8, 9?

- Each with thousands of variations?

The Math: 5,842 “4”s + 6,742 “1”s + 5,958 “7”s + … = 60,000 total digit variations in MNIST

The Reality: Traditional programming completely fails at this scale!

# Just for digit "4" variations:

def recognize_4_style_1(image):

# Check specific pixel regions...

def recognize_4_style_2(image):

# Different thresholds...

def recognize_4_style_3(image):

# More pixel regions...

# ... thousands more functions

# Now repeat for digits 0-9

# Each digit needs thousands of variations

# = Tens of thousands of functions

# = COMPLETELY IMPOSSIBLE

# Plus: what about handwriting styles

# we haven't seen before?Neural Networks Explained

Step-by-step neural network explanation - Generated from manim class: NeuralNetworkExplained - RevealJS: 34 interactive slides - Other formats: Consolidated video - Use arrow keys or space to navigate (RevealJS only)

Neural Networks Explained Video

Interactive presentation covering step-by-step neural network explanation

Video Details: - Duration: Full scene progression - File size: 5.2 MB - Format: MP4 (consolidated from 34 slides)

Neural Network Training and LLMs

From training basics to large language models - Generated from manim class: NeuralNetworkTrainingAndLLMs - RevealJS: 38 interactive slides - Other formats: Consolidated video - Use arrow keys or space to navigate (RevealJS only)

Neural Network Training and LLMs Video

Interactive presentation covering from training basics to large language models

Video Details: - Duration: Full scene progression - File size: 7.5 MB - Format: MP4 (consolidated from 38 slides)

Prompt Engineering

The “Quick Question” Approach

“How do I beat the S&P 500 over the next 10 years—with AI disrupting everything and deglobalization breaking supply chains faster than I break my New Year’s resolutions?”

What kind of response would you expect from ChatGPT?

ChatGPT’s Actual Response*

ChatGPT

GPT-4

*Neither OpenAI nor the presenters endorse or recommend this investment strategy. This response is provided for demonstration purposes only.

The Well-Crafted Version

👤 Context: “I’m a 45-year-old investment manager with 20 years of experience managing a $50M portfolio. I’ve historically focused on traditional value investing but recognize that macro trends are reshaping markets faster than ever.”

📋 Details: “Current constraints: 10-year investment horizon, moderate risk tolerance (max 25% drawdown), $5M available for new positions. Key concerns: AI disruption across industries, supply chain reshoring due to deglobalization, potential inflation from geopolitical tensions.”

🎯 Goal/Intent: “I want to develop an investment strategy that can outperform the S&P 500 by 2-3% annually over the next decade while adapting to these structural changes.”

📄 Format: “Please provide: (1) Three specific investment themes with rationale, (2) Sample portfolio allocation percentages, (3) Key risks and mitigation strategies, (4) Quarterly review checkpoints.”

Well-Crafted Prompt Results*

ChatGPT

GPT-4

*Neither OpenAI nor the presenters endorse or recommend this investment strategy. This response is provided for demonstration purposes only.

The Challenge: The Chicken and Egg Problem

Prompt engineering requires a detailed conception of the problem space and desired response.

What We Often Have:

- 🤔 Vague sense of what we want

- 🎯 General goal or outcome

- 📝 Initial curiosity or question

- 🌫️ Fuzzy understanding of the domain

What Good Prompts Need:

- 📋 Specific context and constraints

- 🎯 Measurable objectives

- 📄 Desired output format

- 🔍 Domain expertise to ask the right questions

How do you write a detailed prompt when you don’t yet know what details matter?

The Solution: Meta-Prompting

Have ChatGPT Write Your Prompt

The Meta-Prompt:

“I’m working on [insert your project]. Help me craft the optimal ChatGPT prompt for it. Ask me everything you need to get started.”

What This Does:

- 🤖 AI becomes your prompt consultant

- ❓ It asks clarifying questions

- 📋 Guides you through the structure

- 🎯 Helps identify what details matter

Why It Works:

- 🧠 AI knows prompt best practices

- 🔍 It can identify missing information

- 📝 It structures your thinking

- ⚡ Iterative refinement process

Live Meta-Prompting Demonstration*

ChatGPT

GPT-4

*This is an actual meta-prompting conversation. Response is provided for demonstration purposes only.

Two Paths to Professional Prompts

🎯 Well-Crafted Approach

“I’m a 45-year-old investment manager with 20 years of experience managing a $50M portfolio. I’ve historically focused on traditional value investing but recognize that macro trends are reshaping markets faster than ever. Current constraints: 10-year investment horizon, moderate risk tolerance (max 25% drawdown), $5M available for new positions. Key concerns: AI disruption across industries, supply chain reshoring due to deglobalization, potential inflation from geopolitical tensions. I want to develop an investment strategy that can outperform the S&P 500 by 2-3% annually over the next decade while adapting to these structural changes. Please provide: (1) Three specific investment themes with rationale, (2) Sample portfolio allocation percentages, (3) Key risks and mitigation strategies, (4) Quarterly review checkpoints.”

🤖 Meta-Prompt Approach

“Act as a global macro investment strategist. Build a medium-term, public markets investment playbook organized by sector, identifying opportunities and risks driven by (1) accelerating AI disruption and (2) deglobalization trends such as supply chain reshoring, tariffs, and geopolitical fragmentation. I want a mixed approach that includes AI enablers, adopters, and disrupted incumbents. Focus particularly on semiconductors, education, and creative industries. The goal is to improve portfolio performance while maintaining a balanced risk profile. Include relevant asset classes across geographies. Structure the response as a sector-by-sector analysis including investment thesis, key drivers, representative equities or ETFs, and risks. This strategy will be reviewed every six months.”

Key Insight: Both approaches produce professional-quality prompts!

Choose based on your expertise level and preference for control vs. guidance.

Grounding GPTs in Reality

The “Current Information” Problem

“What’s the latest on Nvidia’s Q1 2025 earnings and how should this impact my semiconductor investments?”

Remember those LLM limitations we discussed?

Claudes’s Response: Outdated and Uncertain*

Claude

*Actual Claude response demonstrating training cutoff limitations.

The Grounding Solution: Current Documents Or Web Search

🔄 The Problem:

- ❌ Training cutoff dates

- ❌ No real-time information

- ❌ Generic, outdated advice

- ❌ Potential hallucinations

- ❌ No source verification

✅ The Solution:

- ✓ Upload documents or use web search

- ✓ AI analyzes fresh data

- ✓ Specific, current insights

- ✓ Grounded in real information

- ✓ Every claim cites sources

Transform AI from “Creative Writer” to “Research Analyst”

The Results: Grounded, Verifiable Analysis*

Claude Projects: Q1 2025 Investment Research

*Example of grounded analysis with source citations. Actual results will vary based on current documents.

Claude Projects: Full-Featured AI Research Tool

🏗️ Core Capabilities

📄 Massive Context Window

- Upload 200K+ tokens (500-page book equivalent)

- Multiple document types: PDFs, code, reports, data

🤖 Custom Instructions

- Define AI’s role and expertise per project

- Maintain consistent analysis approach

- Set specific output formats and requirements

🧠 Persistent Memory

- AI remembers all previous conversations

- Build knowledge base over time

- No “cold start” problem for ongoing projects

⚡ Grounded Research Benefits

✅ Current Information Analysis

- Upload latest reports, earnings, research

- Get specific insights from your documents

- Every claim includes source citations

✅ Professional Quality Output

- Analysis grounded in your specific data

- Eliminates hallucinations and outdated info

- Verifiable results with page references

✅ Team Collaboration

- Share projects across team members

- Collaborative conversation history

- Consistent analysis approach organization-wide

Beyond Finance: Broad Applications

📊 Business Strategy

- Upload reports + market research

- Get competitive analysis with citations

🏗️ Project Management

- Upload project plans + status reports

- Get progress analysis with citations

⚖️ Legal Analysis

- Upload case law + regulations

- Get current legal interpretations

🎓 Academic Research

- Upload latest papers in your field

- Get literature summaries with citations

Key Principle: AI + Current Documents OR Web Search = Grounded Intelligence

Model Types & Trends to Watch in 2025

🎯 Language Action Models

AI that takes actions in digital environments, not just generates text.

Value: Bridge the gap between understanding and doing.

⚡ Mixture of Experts

Architecture that activates specialized sub-models for each task.

Value: Massive performance without massive costs.

📱 Small Language Models

Efficient models that run locally on your devices.

Value: Privacy-first AI with no data leaving your control.